Understanding Mortgage Refinancing: A-Side vs. B-Side Lending in Canada

By Avaljit Sandhu, Mortgage Professional – Dominion Lending Centres

What Is Mortgage Refinancing?

Refinancing is when you replace your existing mortgage with a new one, often with different terms. This can help you:

-

Access equity (cash out refinance)

-

Consolidate debt

-

Get a better interest rate

-

Change your mortgage term or product type

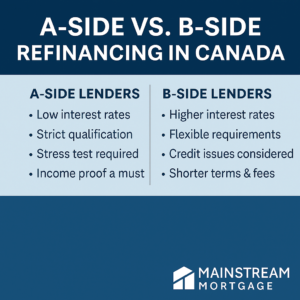

Whether you refinance with an A-side lender (bank or credit union) or a B-side lender (alternative lender), the process and goals are similar — but qualifications, rates, and costs vary.

A-Side Refinance: What You Need to Know

Who Are A-Side Lenders?

A-side lenders are traditional banks and credit unions. They offer the lowest rates but have strict qualification rules.

Key Features of A-Side Refinancing:

-

Low interest rates (based on posted rates or discounted offers)

-

Qualify using the stress test (current rate + 2%)

-

Ideal credit score needed (680+ typically preferred)

-

Low debt ratios

-

Income proof is a must (e.g., full-time, stable job or solid business income)

Best For:

-

Homeowners with good credit, consistent income, and low debt

-

Those looking to access equity for renovations, investments, or large purchases

B-Side Refinance: What to Expect

Who Are B-Side Lenders?

B-lenders are alternative lenders who provide options for people who don’t fit into the strict rules of big banks. They are also fully regulated and legal lenders.

Key Features of B-Side Refinancing:

-

Higher interest rates (but often still lower than unsecured debt)

-

Easier qualification (flexible on credit and income)

-

Can use stated income (for self-employed or commission-based)

-

Shorter terms (usually 1–2 years, interest-only sometimes offered)

-

Lender/broker fees apply (often 1–2%)

Best For:

-

Self-employed borrowers with non-traditional income

-

People with bruised credit or recent financial challenges

-

Homeowners needing to consolidate high-interest debt quickly

Why Consider Refinancing?

✅ Consolidate Debt

Roll credit card, line of credit, or personal loan balances into one monthly mortgage payment — often at a lower rate.

✅ Access Equity

Use the value in your home to renovate, invest, pay tuition, or support a business.

✅ Lower Your Monthly Payments

Refinance into a longer term or lower rate to reduce your cash flow burden.

✅ Change Your Mortgage Type

Switch from a variable to fixed rate (or vice versa) based on your comfort with risk.

Important Considerations Before Refinancing

💡 Mortgage Penalties

If you break your mortgage early, your current lender may charge a penalty. We’ll review this cost upfront.

💡 Legal & Appraisal Fees

Refinancing requires a new mortgage contract, and legal or appraisal costs may apply (especially on B-side deals).

💡 Qualification Rules

Whether it’s A or B-side, we’ll help you understand how income, credit, and equity affect your approval.

How I Can Help

As a mortgage professional with Dominion Lending Centres, I shop both A and B lenders to help you refinance with the best option for your unique situation. I guide you through:

-

Reviewing current mortgage and penalties

-

Calculating how much equity you can access

-

Comparing A vs. B lenders

-

Understanding rates and fees

FAQ: Refinancing in Canada

Q: Can I refinance with bad credit?

A: Yes — B-side lenders offer refinance options for clients with lower credit scores or past delinquencies.

Q: How much equity do I need to refinance?

A: You usually need at least 20% equity (i.e., your mortgage balance must be 80% or less of your home’s value).

Q: Do I need income to refinance?

A: Yes — but B-lenders are more flexible. Self-employed or commission earners can use bank statements or stated income.

Q: How long does refinancing take?

A: Typically 2–3 weeks, depending on the lender, appraisal, and how quickly documents are submitted.

Ready to Refinance? Let’s Talk

Whether you’re a homeowner with perfect credit or someone facing challenges, I can help you explore refinancing solutions on both A and B sides.

📞 Call or text: 204-914-6812

📧 Email: avaljit@mortgagebyaval.ca

🌐 www.avaljitmortgages.ca

1) Are there limits to my coverage?

1) Are there limits to my coverage? Why Use a Mortgage Broker?

Why Use a Mortgage Broker? What’s Your Budget?

What’s Your Budget?