Canadian Inflation Surged to 2.6% in February, Much Stronger Than Expected

The Consumer Price Index (CPI) rose 2.6% year-over-year (y/y) in February, following an increase of 1.9% in January. With the federal tax break ending on February 15, the GST and HST were reapplied to eligible products. This put upward pressure on consumer prices for those items, as taxes paid by consumers are included in the CPI.

While the second straight acceleration in the headline number was expected, the pace of price gains may still surprise Bank of Canada policymakers, who cut interest rates for the seventh straight meeting. Donald Trump’s tariff threats hamper business and consumer spending. But assuming the federal sales tax break hadn’t been in place, Canadian inflation would have jumped even higher to 3% in February. This is at the upper bound of the bank’s target range, from 2.7% a month earlier. Canadian inflation has not been at or above 3% since the end of 2023.

Faster price growth was broad-based in February, the end of the goods and services tax (GST)/harmonized sales tax (HST) break through the month contributed notable upward pressure to prices for eligible products. Slower growth for gasoline prices (+5.1%) moderated the all-items CPI acceleration.

The CPI rose 1.1% m/m in February and 0.7% on a seasonally adjusted basis. However, the increase exceeded the tax impact as seasonally-adjusted CPI excluding the tax impact was +0.4%. And, in case you want to pin it on food & energy, CPI excluding food, energy & taxes was +0.3%.

Gains were across the board, with the sectors impacted by the tax change seeing the most significant increase: recreation +3.4%, food +1.9%, clothing +1.6%, and alcohol +1.5% more to come next month, with the tax holiday only ending in mid-February. The headline inflation figures are subject to as much noise as we’ve seen in decades. They are poised to continue for at least another couple of months, making it very challenging to interpret the inflation data.

As a result, prices for food purchased from restaurants declined at a slower pace year over year in February (-1.4%) compared with January (-5.1%). Restaurant food prices contributed the most to the acceleration in the all-items CPI in February.

Similarly, on a yearly basis, alcoholic beverages purchased from stores declined 1.4% in February, following a 3.6% decline in January.

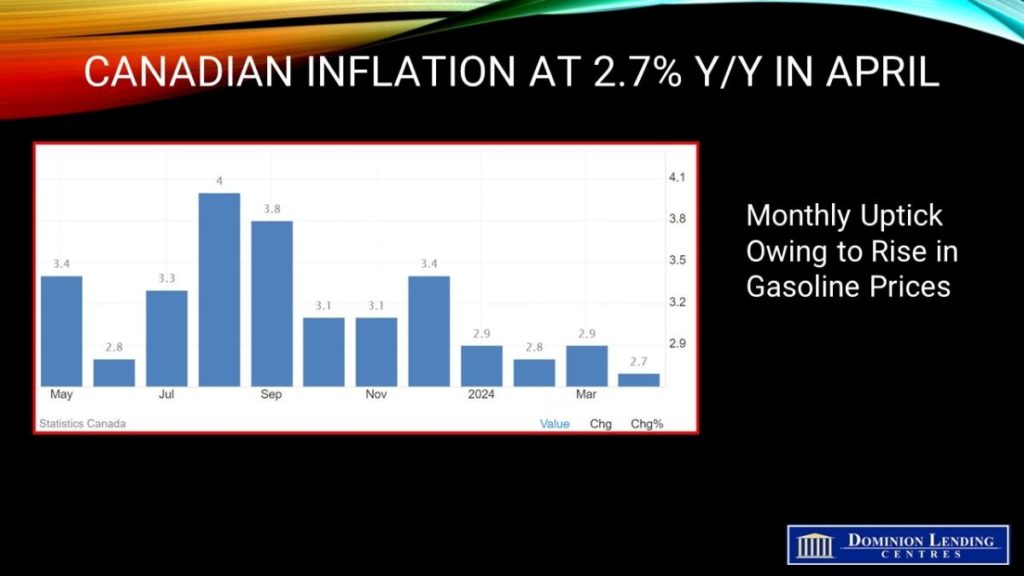

On a year-over-year basis, gasoline prices decelerated, with a 5.1% increase in February following an 8.6% gain in January. Prices rose less month over month in February 2025 compared with February 2024, when higher global crude oil prices pushed up gasoline prices, leading to slower year-over-year price growth in February 2025. Month over month, gasoline prices rose 0.6% in February. This increase was primarily related to higher refining costs amid planned refinery maintenance across North America. This offset lower crude oil prices, mainly due to increased American supply and tariff threats, contributing to slowing global growth concerns.

One notable exception to the broad-based strength was shelter, rising “just” 0.2%. That’s the smallest gain in five months, trimming the yearly pace to 4.2%, the slowest since 2021, with more downside to come. Mortgage interest costs rose a modest 0.2% for a second straight month, slicing it to +9% y/y, ending a 2½-year run of double-digit increases.

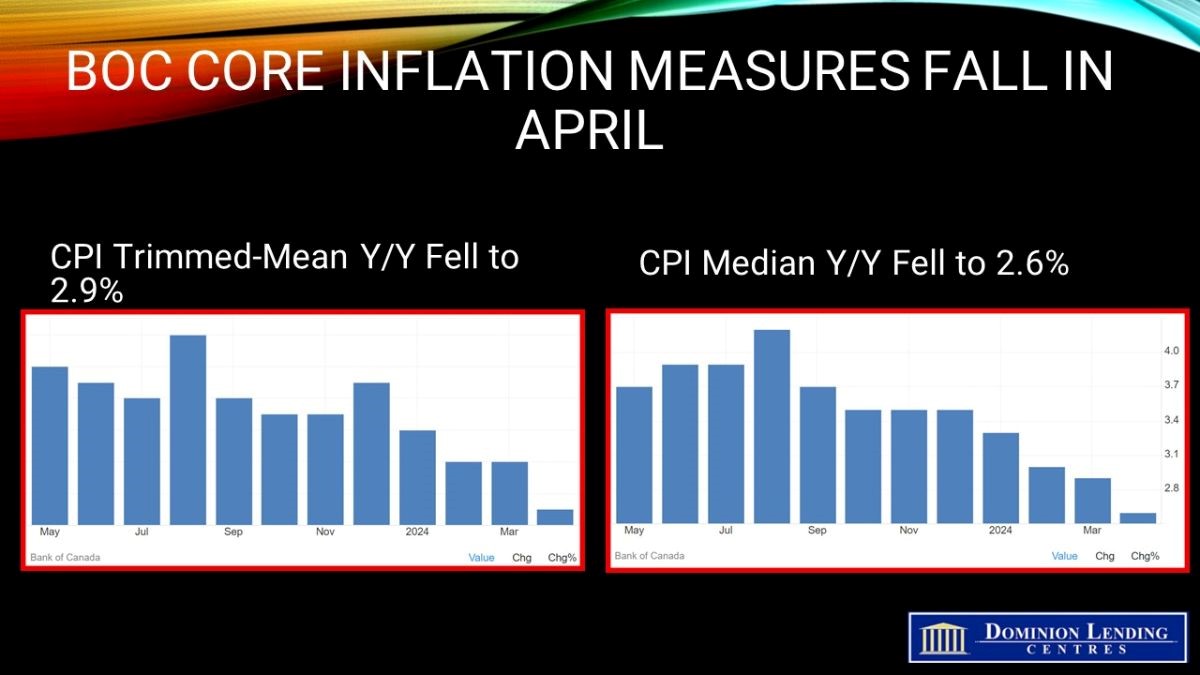

Not surprisingly, the core inflation metrics were firm as well. CPI-Trim and Median both rose 0.3% m/m and 2.9% y/y. The 3- and 6-month annualized rates are all above 3% as well, pointing to ongoing stickiness. The breadth of inflation, which has been a focus for the Bank of Canada, also worsened with the share of items rising 3%+ increasing modestly. None of this is encouraging news for policymakers.

Bottom Line

This report will reinforce the Bank of Canada’s cautious stance on easing to mitigate the impact of tariffs. Notably, the upcoming end of the carbon tax will cause inflation to drop sharply in April. However, March may see an increase in inflation as the effects of the tax holiday begin to reverse. There is still a lot of uncertainty surrounding inflation, which complicates the job of policymakers. We will see what April 2 brings regarding additional tariffs.

If the economic outlook did not worsen, the Bank of Canada might consider pausing after cutting rates at seven consecutive meetings. However, the Canadian economy will likely slow significantly in the coming months.

Bank of Canada Governor Tiff Macklem said last week the bank would “”roceed carefully””amid the tariff war. Economists are still awaiting more clarity on tariffs before firming up their expectations for the next rate decision on April 16, when policymakers will also update their forecasts. Right now, traders are betting that the BoC will hold rates steady in April, but a lot can and will happen before then.

Avaljit Sandhu

vigor and an expectation that rates will continue to come down to a more sustainable level.

vigor and an expectation that rates will continue to come down to a more sustainable level.